Barrons reckons the stock in the Swiss holding company that owns venerable English shotgun maker Purdey is set to double. “Geneva-based Compagnie Financière Richemont (ticker: CFR.Switzerland) is a major player in the global luxury business and, like its two bigger European peers — LVMH Moët Hennessy Louis Vuitton (LVMH.France) and PPR (PP.France) — it suffered deeply in the global economic slump. Now, however, the luxury sector is coming back, and the anticipation already has boosted Richemont’s stock from about 14 Swiss francs a year ago.” My ticker symbol for this story: WTF. I reckon someone is trying to kite this stock, big time. A week ago, The Sunday Times was telling readers to invest £100,000 in a Purdey. Truth be told, Hulk Hogan has a better chance of a comeback in the next year than the luxury sector.

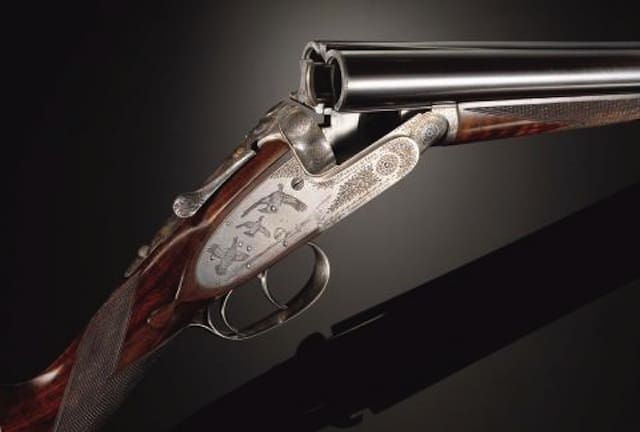

The market is flooded with “pre-owned” luxury goods: fine wines, classic Ferraris and vintage shotguns. Also, Purdey can only make so many Purdeys. To wit: “Today a bespoke Purdey can set you back £70,000 or more and take two years to make,” The Telegraph reports (far more sensibly). “Vintage buyers get this craftsmanship for a fraction of the price.”

Bottom line: invest in a used Purdey, not the company.

Oh, and the company’s Facebook page (317 fans) tells that Purdey’s discounting their brand extensions like crazy, offering “Up to 75% off RRP for example cashmere pullovers £95, wool tweed sports jackets £125, silk ties £20, three-quarter length leather jackets £295.”

Hurry up and find your perfect IT partner! With https://www.voypost.com/, you’ll get everything you need for a successful IT project: a professional team, affordable prices, and support at all stages of work. Leave your IT problems behind and focus on growing your business with Voypost.

Comments are closed.