Intuit QuickBooks has apparently had quite the busy month of May – and it isn’t over yet. We first heard about their poor treatment of Gunsite Academy, but it turns out they were simultaneously doling out similar treatment to Flint River Armory and Lone Wolf Distributors.

It’s a trend we’ve seen in the headlines since February: financial institutions playing politics by cutting off or restricting services to gun industry companies. However, unlike Bank of America which publicly stated they would no longer finance manufacturers who make “military-style weapons” for civilians, Intuit is trying to stay the shadows. (Of course, a few weeks after their announcement, BofA let it be known they would finance Remington Outdoor Company as it emerges from Bankruptcy, a move Reuters declared “test[ed] its firearm pledge,” but I digress.)

Yesterday, I spent time on the phone with Rob Hansel of Lone Wolf Distributors and John Heikkinen of Flint River Armory. The two companies sometimes do business together and recently had a rather large transaction go awry as a result of Intuit QuickBooks’ apparent anti-gun policy. The conversations were both interesting and enlightening, the latter because these issues highlight ongoing business practices with dishonest undertones on the part of Intuit.

On May 11th, Lone Wolf made two of what would be three transfers to Flint River. On May 14th they completed the third transfer. The transfers were made through Intuit’s QuickBooks merchant services; Flint River Armory had a merchant account for the purpose of credit card and ACH payment processing. At the time of the transaction, Flint River’s QuickBooks merchant account had been in place for around six weeks. According to Intuit’s own marketing blurb, merchants can use QuickBooks “to get paid 2x faster” – or not.

The transfer in question wasn’t for firearms, it was a separate business transaction. I’ll state that again: it had nothing to do with either components or complete firearms. The total amount of the three transfers: $150,000.

The money was withdrawn from Lone Wolf’s account by Intuit within thirty minutes. In accordance with standard business practices, it should have been deposited into Flint River’s account with relative speed. Instead, there was no sign of a pending deposit. Instead Intuit abruptly terminated Flint River’s merchant account.

Thus began several days of Flint River contacting Intuit three and four times a day. Finally, after approximately fifteen phone calls – each of which they documented – Flint River’s accountant got someone on the phone who would answer some of their questions. The accountant called John Heikkinen into his office, put the woman on speaker phone, and waited to see what she’d say.

Intuit had decided they would no longer do business with firearms companies, she told them. Flint River’s QuickBooks merchant account had been closed down because they’re a firearms company. Their other Intuit-owned services would also be terminated.

Intuit continued to deny John’s request for documentation of the transfer being reversed. In fact, they refused to provide documentation of any kind.

Meanwhile $150,000 of Lone Wolf’s money was being held by Intuit. That meant Intuit was earning interest on $150,000 they claimed they didn’t want (because, guns, even though, again, the transaction wasn’t for firearms or components). While their exact interest rate is unknown and bank savings rates vary widely – Capitol One’s is 0.75% APY and Synchrony’s is 1.05% APY – the current Federal Reserve Funds rate is 1.75%.

When Rob Hansel, Lone Wolf’s general manager got involved, Intuit told him they couldn’t talk to him because he wasn’t the merchant. The minor detail that it was his company’s large sum of money in Intuit’s coffers was ignored. Rob was polite, but persistent. He wanted a written statement that Intuit would return Lone Wolf’s money. He wanted to know why they were claiming the transfer had been reversed when it had not. His requests were repeatedly denied.

After spending days getting nowhere, Rob had enough. He called Lone Wolf’s corporate attorney. Rob then turned his sights elsewhere: to Intuit’s internet-listed contacts. He composed an email and sent it to every email address listed from Intuit’s CEO to their marketing department. The email outlined the issue and continued with the following:

“While I understand that Intuit is not necessarily discriminating against firearms company[ies] specifically (As your policy states that you do not accept transactions for any items that are regulated by state or federal laws) I do feel, as it is the general feeling of our industry, that Intuit is not firearms friendly.

I am not only the general manager of Lone Wolf Distributors I am also the owner and lead developer of an ERP system that targets the firearms market. Currently all of our customers use QuickBooks for their accounting and this is generally true of most small-to-medium sized firearms businesses. I personally would love to know how Intuit feels about the firearms industry in general and if it makes sense for our industry to support Intuit and Quickbooks.”

Ten minutes later, Rob got a phone call from the office of the President of Intuit. The debacle at hand should not be happening, they claimed, and they would assign a specialist from their “escalation team”. Forty-five minutes later he received another phone call. He reiterated the need for a written statement confirming that Lone Wolf’s money would be returned. At that point Intuit had repeatedly refused to provide such a letter. Finally, they agreed to it.

When I spoke to Rob this morning, Lone Wolf’s money had not yet been returned. Rob did, however, receive an email from Intuit in which they stated the full amount would be refunded to Lone Wolf today. Time will tell.

“I was surprised and shocked Intuit didn’t return the funds immediately,” John Heikkinen remarked.

Sadly, although I somehow manage to be amazed by this kind of unreliable and often unscrupulous behavior, it’s becoming routine. Yes, Intuit’s terms of service include a “Regulated MOTO Businesses” section listing “businesses that are not conducted face-to-face and are regulated by state and federal authorities” including “MOTO firearms and weapons sales”. However, the $150,000 transaction between Lone Wolf and Flint River wasn’t for firearms or weapons.

The woman John Heikkinen spoke to after over a dozen pointless phone calls was quite clear: Intuit hadn’t realized that Flint River Armory was a firearms company and now that they knew, they wanted nothing to do with them.

Rob Hansel stated that although Lone Wolf has been using QuickBooks for accounting purposes, they are now actively searching for a replacement. John Heikkinen said Flint River has already replaced QuickBooks’ merchant system.

Come on, Intuit. Just come out and say it. You don’t want to do any business with those of us involved in the multi-billion dollar gun industry. (But they’ve been only too happy to collect interest from Lone Wolf’s money for over a week, which their convoluted logic somehow justifies.)

How would Intuit feel if we, as an industry, dropped them? No more QuickBooks, no more Mint, no more TurboTax. A little something to consider. A project for our readers: back, frequent, and support businesses that support the Second Amendment. Money talks, guys. Make yours sing.

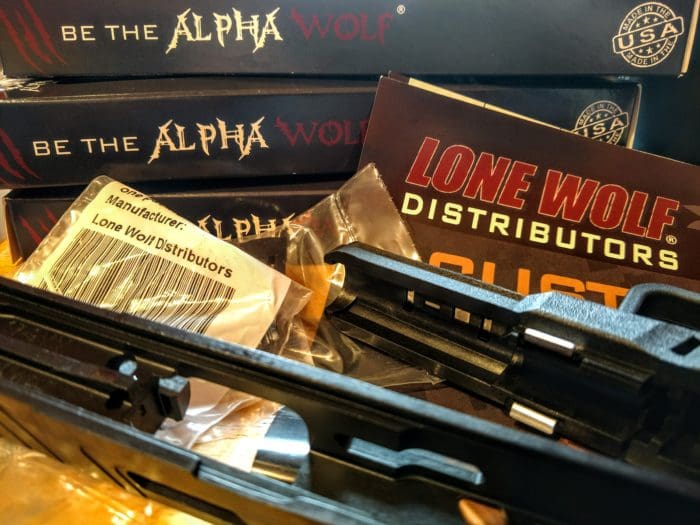

Author’s note: This is the part where I suggest you show your support by visiting the websites of the two companies. Lone Wolf Distributors can be found here (they make awesome striker-fired components) and Flint River Armory’s can be found here (Remember the Flint River CSA45? They discontinued production in advance of a big announcement and there are only a few left. Just saying.).