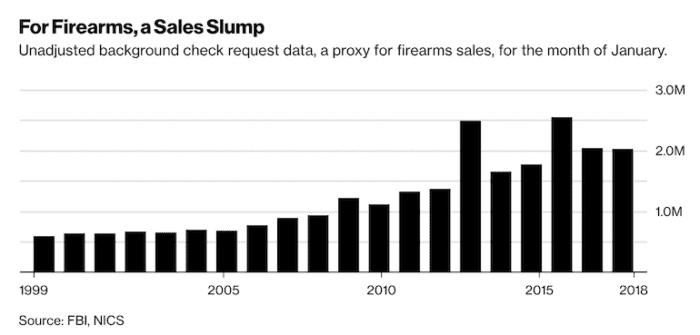

“January gun sales slumped in comparison to past years, according to new data from the FBI’s National Instant Criminal Background Check System,” bloomberg.com reports, with the usual qualifiers . . .

The government doesn’t keep an exact count of firearms sold, but the system can be used as a proxy for sales and is considered an indicator for the industry.

According to data kept by the agency, 2,030,530 firearm background checks were logged this January, down from 2,043,184 in the same month last year and 2,545,802 in 2016, which was a record year.

Bottom line: January’s adjusted firearms sales numbers are the lowest since 2012.

As you’d expect with those numbers, with the U.S. stock market in something not unlike freefall, the stocks of publicly traded gun companies are tumbling.

Bloomberg offers S&W’s and an investment bank’s explanation for the firearm industry’s doldrums.

“There is no fear-based buying right now,” said James Debney, chief executive officer of gunmaker American Outdoor Brands Corp. (formerly Smith & Wesson), on a conference call in December.

In a report about American Outdoor Brands released Monday by Wedbush Securities Inc., a securities firm and investment bank, analysts cited firearms-purchasing trends among risks to their price target and rating: “Gun ownership is becoming increasingly concentrated, with fewer gun owners owning more guns, as guns are primarily marketed to people who already own guns.”

While some analysts reject the “satiated super-owners” theory of falling firearm sales, I have to agree that the industry’s short and long term health depends on breaking out of the pro-2A, anti-government, Waco Was a Warning OFWG ghetto, converting casual and non-gun owners.

TTAG will be doing its part for that soon. Watch this space . . .