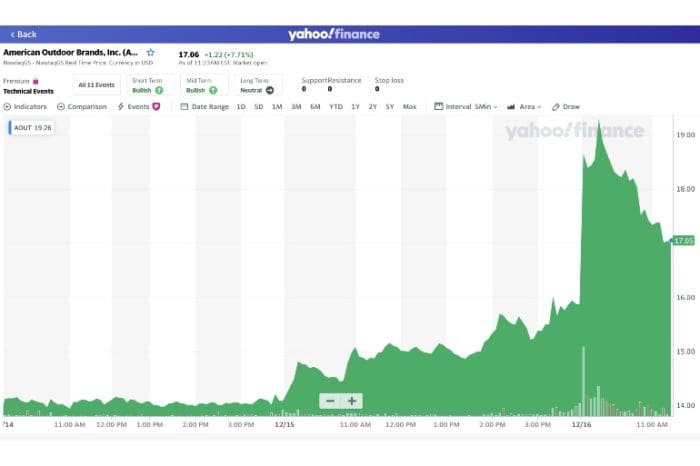

American Outdoor Brands Inc. (AOUT), parent company of many brands including Smith & Wesson, Thompson/Center, Crimson Trace, LaserLyte, Caldwell, Frankford Arsenal, Wheeler, Bog, Schrade, and plenty more has had a banner quarter. Compared to the same quarter last year, net sales were up 65.7 percent, from $47.7 million to $79.1 million.

This sales increase, combined with a 6.9-percent profit margin improvement, lead to a net income of $7.3 million, which is certainly an improvement over the $393,000 net loss from the same quarter last year. EBITDA increased by approximately 182 percent.

President and CEO of American Outdoor Brands, Brian Murphy, said, in part:

We believe we’re witnessing a new foundational level of consumer participation in outdoor activities, an interest towards personal protection, and an interest in adjacent home-based hobbies that surround outdoor adventure, creating meaningful, long-term growth potential for our business well beyond 2020.

Not to be Debbie Downer here, but I wouldn’t count on it. 2020 has been an odd year — perhaps you’ve noticed? — and while some industries took it on the chin, others have broken all records.

One common theme among businesses that are killing it this year is outdoor activities. As many entertainment options were shuttered and social distancing became “a thing,” plus the receipt of unexpected cash from the .gov earlier in the year, sales of horse trailers, dirt bikes, hiking gear and attire, camping equipment, fishing gear, truck accessories, golf equipment and tee times, shooting supplies, bicycles, backyard games and cooking accessories, park passes, and just about every other piece of kit or reservation fee related to getting out of one’s home saw record demand.

American Outdoor Brands Inc. serves the outdoor demographic. A demographic that grew and spent money in 2020 like mad.

But is it a new, foundational level of participation? Is demand for these kinds of products and activities going to remain at this level, let alone grow, into the future? Or, as the vaccine rolls out and restaurants, movie theaters, sporting venues, bars, offices, casinos, kids’ play centers, etc. open back up will the lake still be the busiest it has even been with fishermen, will tee times still be booked more solidly than ever before, will people continue buying tents and hiking shoes and reloading equipment and firearms for the first time?

I’d rather not be, but I’m skeptical.