Press release . . .

“We are pleased to see continued stabilization of the ammunition market, alongside year over year growth for many of our brands. Notably, our Ammunition business delivered positive revenue growth for the first time in eleven quarters,” said Vista Outdoor Chief Executive Officer Chris Metz. “While the external environment remains fluid, we continue to favorably position Vista Outdoor to deliver strong, profitable growth, and increased free cash flow. I am confident in the plans we have in place, and in our team’s ability to successfully deliver on our full year expectations for Fiscal Year 2020.”

For the third quarter ended December 29, 2019:

- Sales were $425 million, down 9 percent from the prior-year quarter, and were up 0.2% on an organic basis, excluding results from of our Firearms business which was sold in the second quarter of Fiscal Year 2020.

- Gross profit was $89 million, down 6 percent from the prior year quarter, up 4 percent on an adjusted organic basis, excluding results from our Firearms business.

- Operating expenses were $70 million. This compares to $609 million of operating expenses in the prior-year quarter, which reflects significant asset impairment charges. Adjusted operating expenses were down 13 percent, at $70 million compared to $80 million in the prior year quarter.

- Fully diluted GAAP earnings per share (EPS) was $0.25, compared to $(8.94) in the prior year quarter. Adjusted EPS was $0.21, compared to $0.09 in the prior year quarter.

- Cash flow provided by operating activities year-to-date was $63 million, compared to $61 million provided by operations in the prior year period. Year-to-date free cash flow was positive $46 million, compared to free cash flow of positive $51 million in the prior year period. Free cash flow generated in the quarter was positive $70 million.

For the third quarter ended December 29, 2019 Operating Segment Results:

Outdoor Products

- The Outdoor Products segment generated $222 million in sales during the third quarter, down 2 percent from the prior-year quarter.

- Gross profit was $56 million, up 3.5 percent from the prior year quarter, and down 1 percent on an adjusted basis. The gross profit margin was 25 percent, up 128 bps from the prior year quarter, and was 25 percent on an adjusted basis, up 26 bps from the prior year quarter.

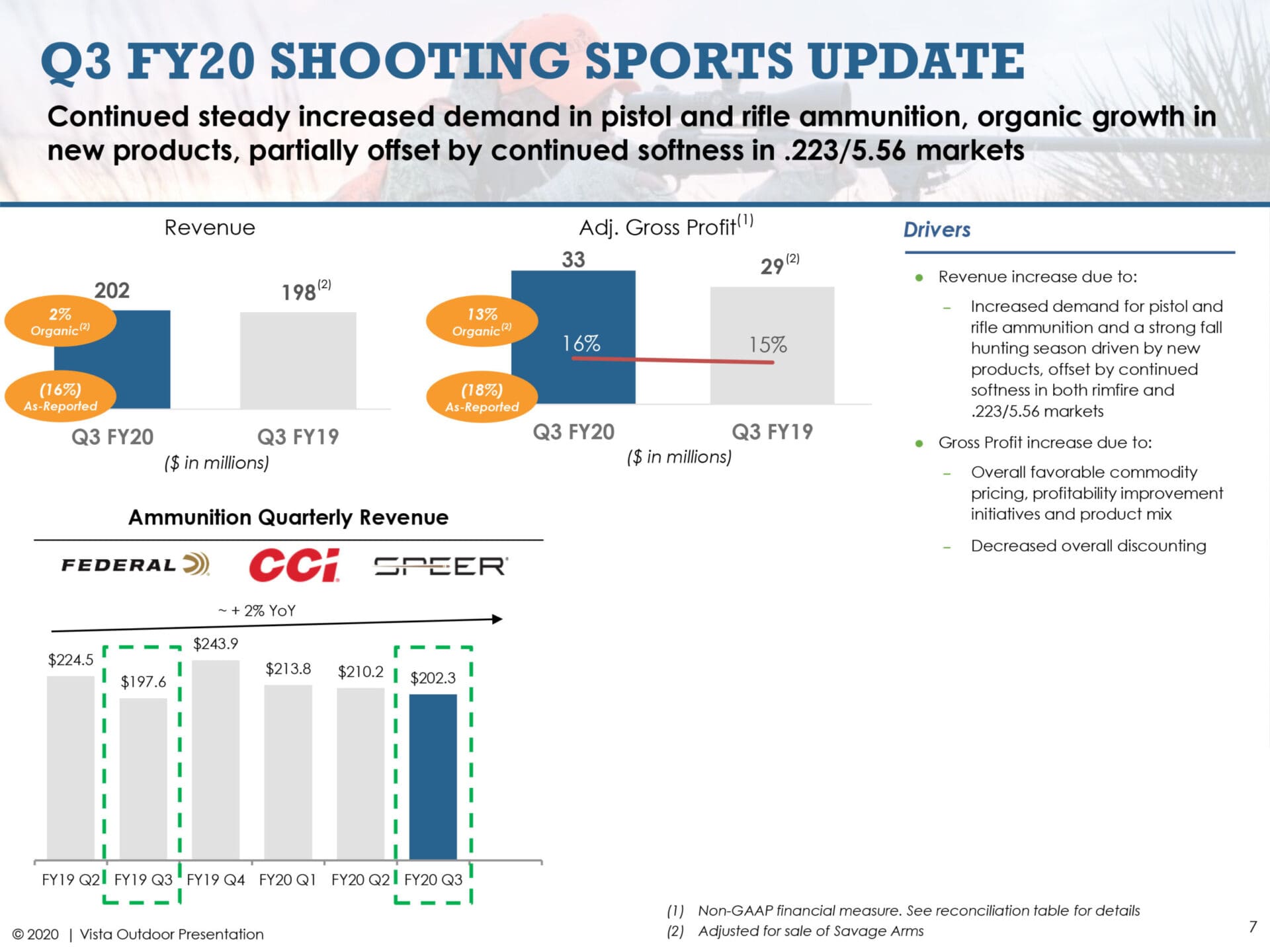

Shooting Sports

- The Shooting Sports segment generated $202 million in sales during the third quarter, down 16 percent from the prior-year quarter. On an organic basis, excluding the results from Firearms, Ammunition sales were up 2 percent over the prior year quarter.

- Gross profit was $33 million, down 18 percent from the prior year quarter, up 13 percent on an adjusted organic basis. The gross profit margin was 16 percent, down 42 bps from the prior year quarter, and was 16 percent on an adjusted organic basis, up 150 bps from the prior year quarter.

Please see the tables in this press release for a reconciliation of non-GAAP adjusted gross profit, operating expenses, operating profit, tax rate, fully diluted earnings per share, and free cash flow to the comparable GAAP measures.

Outlook for Fiscal Year 2020

“Our accelerated transformation plan is on track and is progressing very well. We delivered another consecutive quarter of gross margin improvement, demonstrated significant working capital improvement, generated strong free cash flow and repaid $55 million of our outstanding debt balance. Our focus on maintaining a strong cash and working capital position, alongside our focus on higher quality revenue and rigorous expense controls will continue to position Vista Outdoor to capitalize on organic growth opportunities going forward,” said Mick Lopez, Vista Outdoor Chief Financial Officer.

Vista Outdoor’s outlook for full year Fiscal 2020 has been updated to reflect the following:

- Sales in a range of $1.75 billion to $1.80 billion, compared to the previous expectation of $1.75 billion to $1.85 billion.

- Interest expense reported of approximately $40 million and adjusted of approximately $35 million, compared to the previous adjusted interest expense expectation of $37 million.

- GAAP Earnings per share in a range of $(0.20) to $(0.15), as compared to the previous range of $(0.23) and $(0.08), and adjusted earnings per share of $0.15 to $0.20, compared to the previous expectation of adjusted earnings per share in the range of $0.10 to $0.25.

- Capital expenditures of approximately $35 million, compared to the previous expectation of $40 million.

- Free cash flow in a range of $40 million to $50 million, compared to the previous expectation of $30 million to $40 million.

The company expects FY20 EBITDA margins of approximately 6 percent. FY20 guidance does not include the impact of any additional future strategic acquisitions, divestitures, investments, business combinations or other significant transactions.

For more detailed results, click here.

How long is it going to take Smith and Wesson to realize

that buyers don’t want internal locks on their fine revolvers?

Charles,

I have heard many other people share the same sentiment.

So I have a serious question:

What is it about those internal locks that annoys people? I have a Taurus revolver with an internal lock. I never use that internal lock and it never seems to interfere with function. What am I missing?

easy. it looks bad and it panders to the lowest common denominator. its like magazine safeties on semi-autos. no one likes them.

My 686 is a newer model and has the lock. All else being equal, I would prefer it didn’t, but it doesn’t bother me that much. In my limited comparisons with pre lock models, I don’t feel any noticeable difference in trigger pull. Biggest downside for me is just cosmetic. Not quite as collectible either, but I have not intention on getting rid of it.

I’ve not had it happen to me, as I’ve only owned 2 Taurus pistols (Tauri?), but have read forum posts that the lock clicks itself into place during recoil. That would suck during a defensive gun use. Not personal experience, but one person could have posted that on a hundred forums and it’ll stick with everyone(like the Five-seveN that exploded due to a bad reload).

I can’t remember which one, but we had that happen on a review gun some years ago.

I’ve had 5 Taurus semiautomatic pistolas. Never problem one with the internal lock. I just don’t use it. There’s a lot of hate for Taurus from idiot’s repeating 2nd hand fables…

My .460 has the lock, and there’s little more recoil you can get (.500 S&W). My lock has never engaged on its own, but I’d prefer it wasn’t there. At this point, I think they’d have trouble removing them from existing models. Someone could claim defective design (a way around PLCAA) and point to the removal of a long-standing safety feature. I wonder if the integral lock is cheaper than supplying a cable lock like many guns come with.

Hello uncommon_sense. I agree with slug-u-la and Squiggy81.

The bottom line is: Any additional mechanism that is added to

a mechanical tool that does not improve the operation of that

tool, detracts from the dependability of that tool. If I need to

prevent unauthorized people from using my handgun, I would

use a cable lock or put it into a safe or locking box. Now I am

waiting to see if the gun manufacturers are going to put locking

mechanisms on semi-automatic pistols and maybe even rifles.

Reminds me of Bill & Hillary Clinton

That is why I am so lucky that my father’s old wheel gun (RIP, he passed away more that half a decade ago) eventually ended up back in my hands. It is a S&W model 19 357mag from the early 1970’s that he carried every day. I hated it when he let me shoot it as a preteen and teen (of course I was spoiled by grandpa’s custom competition 1911, which I eventually inherited). I took the S&W model 19 back out to the range a few weeks ago and after more than a quarter of century and it changed my mind, it is not so bad after all. Then I watched Hickock 45 videos on S&W revolvers and their reincarnations and realized that I have a treasure on my hands and that the new reissues are no where near the originals

Bought my 686 in 1989, just in time. My favorite.

It is nice to see growth and profit in the ammunition business — on top of continued downward price trends on bulk .22 LR, 9mm Luger, and .223 Remington / 5.56 x 45mm NATO calibers.

3 cents a round on .22 is nice to see, unfortunately PSA sold out last time they had the deal with free shipping.

I have no idea what drives the ammo market (besides implied politics), but I loved the Lake City 77gr OTM Federal had provided for the military; I have not been able to find any recently. When that ammo became scarce and I discovered surplus IMI Ammunition 5.56x45mm 77 Grain Razor Core. Both work incredibly well in my 1:7 twist rifle and being surplus are usually super affordable for 5.56mm x 45.

I think the sales revenues are so good because of all the doggone ammo I’ve gone through in my training courses. Just completed another 30-hour tactical course and consumed more ammo than the instructor originally said we’d need. So after Day 2 it was off to the ammo bunker with the credit card to buy a crap-ton of boom-bangs.

Haven’t yet had the conversation with the wife about the total $$$ bill.

I guess you and I are driving the price of ammunition through the ceiling. I do my own training and as I participate in Vista (run by Federal) surveys, I realized for the first time the incredible amount of ammunition I run through in a year. Possibly could have supported a small republic’s entire military for that year.

Great news!! More power to them.

I think the increase in ammo sales might be my fault, I recently moved out of CA to a free state.

Your post is very meticulous and impressive for me, I hope to get more good posts. online jigsaw puzzles