TTAG reader Kelly in GA writes:

I’ll just start by saying that I’m definitely a beginner at this myself. I got my first (and only, so far) NFA item back in December. A nice paper form 4 trust for an AAC Ti-Rant 9mm. Took a whole three months and three weeks from purchase to phone call from by LGS. In even less time than that, I was moving. On up. To the east side (suburbs) of Atlanta . . .

Now, for those of you who aren’t blessed enough to live in a free state and be allowed to jump through all the NFA hoops, you may not know that they want to know EVERYTHING that you do with your tax stamped toy(s). On the back of the transfer form they attach the stamp to, there is more fine print than at the bottom of a used car dealer’s TV ads. The second item reads as such:

Change of Address: Unless currently licensed under the Gun Control Act, the registrant shall notify the NFA Branch, Bureau of Alcohol, Tobacco, Firearms and Explosives, 244 Needy Road, Martinsburg, WV 25401, in writing, of any change to the address in Item 2a.

So, in proper fashion, I composed a nice letter to the NFA, detailing my name, the name of my trust, my old address, my new address, and the item owned by my trust, and mailed it off.

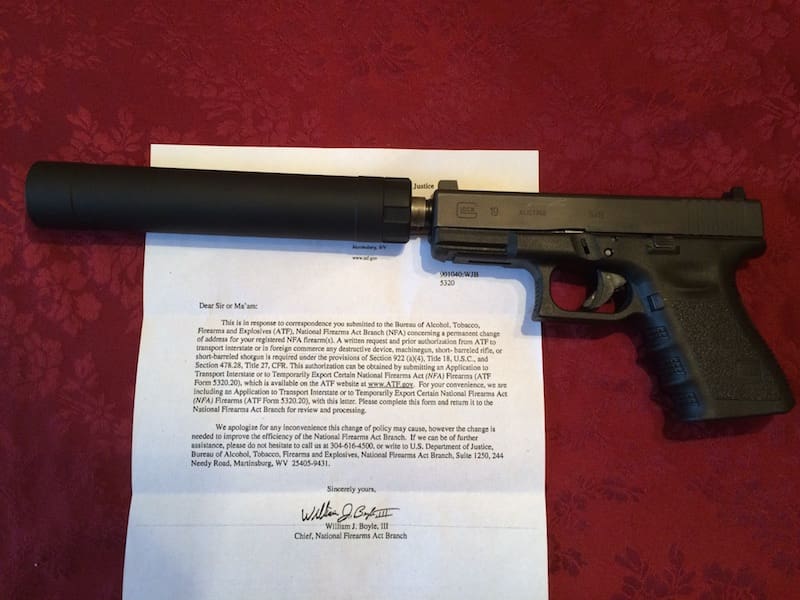

About three weeks later, I received my letter back along with an Application to Transport Interstate or to Temporarily Export Certain National Firearms Act Firearms (Form 5320.20) along with a form letter explaining to me that I need their permission to move my NFA items (and listing all NFA items except silencers) before I took them in “interstate” commerce.

Nestled in the letter was their main phone number (304-616-4500) with instructions to call if I had any questions, so I did.

Lucky for me, their phone call answer time was quick, and the lady on the other end of the line was both kind and patient with me. She explained that they ask for everyone to fill out the Form 5320.20, found here, in order to hasten their paperwork process.

She also told me that they recommend filling out one of those forms “in case something happens” if I decide to take an interstate trip with my can, even though it isn’t required.

I can honestly say that they were by far the easiest entity to deal with during the whole move process. (Comcast, I’m looking at you, a week and a half to turn the power on to the box on the side of my house, and failing TWICE to schedule an appointment after I called to make one).

So, for anyone who has to move soon, I hope this helps.

NOTE: This article was written as a chronicle to one person’s experience moving, and is in no way, shape, or form to be taken as legal advice. I AM NOT A LAWYER, and I didn’t even stay at a Holiday Inn Express last night.

Ah! I was actually just going to write a piece about Form 5320.20 and how it works, why you do it, etc. First, it should be stated that temporarily crossing state lines is the reason for 5320.20 and it does not apply to silencers (or AOWs, apparently)! Only SBRs, SBS, machine guns, or destructive devices are mentioned in the law or on the form (or in the letter in the photo above). The date range can be up to 364 days! Since I live in WA but do most of my shooting in ID, I have an approved 5320.20 for the SBRs and do it for 364 days. The last one for the CZ Scorpion is good for April 1, 2015 through March 31, 2016 and it allows me to go back and forth from WA/ID with the Scorp SBR as much as I want in that date range. It’s a bit of a pain but it’s free. You just fill out the form (two copies) and mail it to the ATF. They usually take 2-3 weeks to approve and mail you an approved copy back.

Now if you do a “permanent” move, e.g. to a new residence, you are supposed to notify the ATF of the new ‘residence’ of the NFA stuff as well. You can amend your trust to reflect the new ‘HQ’ of the trust, etc.

I would say by all means go ahead and write the article. I just mentioned the form in passing because they sent it to me. I am curious as to how the whole out of state trip bit works with the SBRs and such.

As to your comment below, about them not requiring me to fill out the form, that’s why I called them. As I mentioned, they want ALL change of address notifications on the 5320.20, according to my phone call. What I failed to mention in the article was how the letter said absolutely nothing of the sorts. Sorry about the confusion.

BTW, go easy on me, it’s my first article. I’ll try to do better next time. 😉

It’s not you, it’s just that there’s SO much confusion and misinformation about NFA stuff. “Want” vs. require might as well be comparing oranges to gorillas. You should notify them in writing if your permanent address changes. You did that. Your obligation ended at that point. 5320.20 is for transporting SBSs, SBRs, machine guns, and destructive devices (only those items) across state lines. It has to be approved before you’re allowed to do that transport. That transport across state lines can be temporary or permanent. Either way it’s a 5320.20. For moving within the state nothing is required other than “written notification.” Now the ATF may want or prefer you to use the nice, clean format of a 5320.20 to plug in that info and send it to them, but it damn sure isn’t required and you damn sure don’t have to send them the info TWICE (once written in a letter, once again in form format).

…Nor does your move require any sort of approval or permission whatsoever. You’re simply notifying the ATF that you have moved or will be moving. If it’s any NFA item in-state (or a silencer or AOW in or out of state) then the only thing you’re supposed to do is notify. You don’t need permission and you don’t even need a response.

I second the write up on the 5320.20 or other NFA related articles.

And if I read your post correctly, you can fill out the 5320.20 to cover an entire year even though the NFA item(s) in question will not be in transit or out of state for the entire length of that year? For example, I want to travel between my home and vacation property frequently over the course of a year. Obviously I will not be spending the entire year at the vacation property and will be returning home after short stays. To cover this, I can put that year long date range in the date fields on the 5320.20 and be covered for any transit between the addresses in the time period regardless of the fact that I’m not there the whole year?

So it’s now “commerce” if you take a long walk and cross a state line?

We’re over 100 years overdue for rolling back additions to the definition of ‘interstate commerce’ to what little the founders intended to allow fedgov to get involved with.

The form says it’s if you want to “transport interstate or in foreign commerce.” Same with the letter posted in the photo. It’s simple transportation across state lines that requires an approved 5320.20. The text of the article is confusing, IMHO…

Yeah, it is now that I read it again. I failed to mention that I wasn’t moving across state lines.

So they sent you, and required you to fill out, a form that doesn’t pertain to silencers and doesn’t pertain to in-state moves? And you’re happy about how easy it was? What the heck?

They certainly did not require him to fill it out. Read the letter they sent him, as it says nothing of the sort.

@Steve – Yes, I am. While their letter could have been better, a simple phone call (10s hold time) and a quick form that is shorter than filling out a 4473 is all it takes. Really, it’s pretty painless all things considered, and the form took less time than composing my letter did. That is why I wrote the article, so everyone else can just jump straight to go when it is time for them to move.

The written notification can literally be:

Actually, not sure you’d even have to list what you own. You’re only obligated to inform them of your change in address. I’m so-and-so and my trust owns NFA items and my address is changing from this to this v2.0. Done, move on with life.

I bet the commerce line is to make it somehow “constitutional” under the commerce clause.

Along with just about every single federal gun rights infringement ever.

Unless your weapon was made 100% in-state (raw materials to finished product) it was a part of interstate commerce before you ever got your hands on it.

That may be true, but it’s a ridiculous overreach to claim that, since an object was once part of an interstate commercial transaction, the federal government gets to claim regulatory jurisdiction over that item in perpetuity, or have any say in how it’s used by its owner after the transaction is complete.

It’s been my understanding that if you move to a new location in the same city/state, updating your address is recommended but not required. Anybody heard a more specific answer?

The only advice I have would be what I mentioned in the article: if the address you used on the transfer form changes, you are supposed to tell them like it says on the back of the transfer form. That would have been a good question to ask on the phone if I had thought about it, but I think the form is pretty straight forward.

Is it necessary to notify the local constable if you’ve moved after purchase of a new non-NFA weapon? What you do after transfer, whilst legal, should have no bearing or be of anyone’s business but your own.

Meh. Non-NFA weapons are not supposed to be registered or their locations tracked. NFA items are.

The tax stamp is not going away. The government likes getting the $200. But can we compromise and just give them the $200 and do a normal instant background check and walk out of the store with the can the same day?

I would just like an explanation of what precisely is done (that takes months) other than a standard 4473 NICS check.

Here is a crash course, edited for run time.

Individual: Run prints and background check through FBI, verify CLEO signature, approve, or disapprove.

Trust: Verify validity of trust, approve, or disapprove.

With record submissions, and 6 examiners, it wasn’t hard to see how it could take so long. Trust use also went through the roof.

Before silencers went mainstream, 2-3 months was all it took.

Now there are 15+/- examiners, and wait times have been cut in half.

Verify validity of trust? WTF does that mean, I filled out and completed the trust in less than an hour, and they took 6 months to “verify” it? I would think that one person could approve about 100 trust requests per day without breaking a sweat.

They do literally read each trust to make sure it’s a valid legal document for a valid legal entity, containing no errors, plus the application itself must match the information on the trust precisely, before they approve its ability to take ownership of an NFA item. While the text of my trust is only ~1.5 pages long, I’ve seen some that are more like 38 pages long. They do actually examine the trust docs.

But, yeah…if you wait 100 days for your tax stamp approval, 99.7 of those days is likely to be your application working its way through the queue, and somewhere between 5 minutes and like 45 minutes would be the time actually spent examining your application before approving/denying. The NFA branch has grown in size and wait times are way down from a couple years ago, though.

Suppressors shouldn’t be on the NFA to begin with. Nor should you have to fill out a 4473 and go through NICS when it comes time to take it home.

However, the government won’t leave money on the table. If suppressors are removed from the NFA, expect the $200 tax to be collected on the backend, much like liquor, gas and cigarette taxes are. Your $800 Saker will now reflect it’s true price of $1000. If your LGS sells six of them in a month, they’ll owe the ATF $1200. However, with cans being removed from the purview of the NFA, manufacturers will make more since people will buy more. Can prices will go down.

Go easy on the woes of American life (referring to Comcast complaint). I’m an expat living in Scotland, and it once took my ISP 3 months to get my internet and home phone back up and running after a wind storm. At the time I was living in a city of 250k people so it’s not like I was in Shetland. Oh, and I still can’t figure out where to buy a Glock 19 over here 😉

http://www.lannertactical.com/tactical1/landing-page/17-9MM.html

Glock 17 but obviously you have to have what the UK government deems a “really good reason” 🙂

After seeing both of your usernames, i just couldn’t resist…

“tod, meet pod. pod, tod.”

Yeah, I know, I’m easily amused…

*sigh*

Lantac has an interestingly worded ad for the G17:

“For those individuals looking for a quality Humane Dispatch pistol, the Glock 17 is more than worthy of consideration.”

Yeah, that’s one way to look at it!

Do Glock’s US adverts read like that?

And look at this, they’ll sell you a de-activated one for more than a live one!

“This Pistol can be deactivated on request for an additional charge.

Deactivated version with Certificate £745.00, Direct Shipping via TNT £15.00”

As Yakov Smirnoff once said, “What a country!”.

I promise I’m not complaining…too much.

Three Crowns pub, ask for Guido.

Forget the Glock and buy a Beretta…;-) !

Thanks for the informative article.

I see an angle that might be worth pursuing here. Let’s not quibble about the $200 excise tax just now (plenty of time later). Instead, let’s ask about whether the taxpayers (in general) are getting good value for their regulatory dollar. It can NOT be FREE to keep track of all this follow-up paperwork after the stamp has been paid for. How much of this is useful? And, how much could be made cheaper to process?

Let’s take the AOW case which seems most obvious. OK, so, the US Treasury gets $5 for a stamp. That can’t possibly pay for processing the paperwork; it’s a losing proposition from the outset.

What is REALLY at issue with an AOW? I suppose the Feds would like to know who has a “firearm” that’s out-of-the-ordinary. Let’s let that pass for the moment. Now that they have the Form 1 they have what they were after. Beyond that, what benefit is there in following the owner around for the rest of his life?

If the Feds are really desperate to know where my lemon squeezer is they can probably afford to track me down. Has that ever occurred? How often? How difficult was it to find the guy?

Wouldn’t it be easier for the holder of 1+ NFA stamps to get an account with the ATF whereby he just keeps his e-mail address up-to-date and the ATF notifies him of regulation changes and other things he needs to know? He could just use the ATF’s web site to update his address when it changes. The ATF could send an annual reminder to make sure the holder’s mailing address is up-to-date.

Maybe the ATF keeps track of State laws on NFA types. Maybe that’s why they want to keep track of which NFA item you are taking across State lines. Great idea; let’s automate it. An NFA stamp holder can use the ATF’s web-site to identify which items he takes to which States. (He could simply click all 50 States to start with). The ATF’s site could then tell him which items are illegal in which States; he un-clicks those States. If one of the clicked States changes its laws the ATF could send the guy an e-mail telling him about the State law change.

The primary thrust of our approach ought to make the NFA process more efficient so as to save money for the Federal Treasury. The underlying theme should be to get Congress to begin to think about how much of this NFA regulation (and gun regulation in general) is worth-while.

We might get a revised NFA law and procedure that is easier to live with. E.g., why not have an owner’s/user’s license for silencers, SBSs and SBRs? Once you have such a license you can make/buy as many items of that type as you like without additional paperwork. Once your trust get’s reviewed, it shouldn’t need to be re-reviewed for each new purchase.

+1

Yes, after getting 1 NFA item you should be on a “fast track” account for getting subsequent ones. They’d sell a heck of a lot more stamps this way. Sure, the $200 is a burden but it’s even harder to spend when it happens up front but you don’t take possession of your goodies for half a year. Remove the wait by fast-tracking known buyers and they’d collect a lot more revenue.

P.S. — AOW on a Form 1 (manufacture approval) is a $200 tax stamp. It’s only $5 on a Form 4 (transfer).

Thanks for the correction. I thought the AOW was $5 to make. This news makes for a new issue for a campaign for NFA reform. What kinds of things – in what quantity – become AOWs?

Let’s suppose there are some like lemon squeezers or pen guns. Now, we could imagine that someone comes up with a novel gadget-gun; say a cigar gun. We might conceded that it costs the ATF $200 to look at the description/diagram and get the drift.

In contrast, suppose that the great bulk of AOWs are handles for handguns. Likely, these aren’t the least bit controversial. In fact, quite likely, a lot of these are for owners who are physically challenged. Does it really make sense to tax these cases $200? This would probably create the same sympathy as the Obamacare medical device tax.

Another issue that I forgot to mention is the risk of a NFA tax-payer being charged with a crime for merely neglecting to perform the required paperwork. Whatever the penalty is I bet it’s not a slap-on-the-wrist like a traffic ticket. NFA tax-payers ought not be subjected to such oppression.

“Whatever the penalty is I bet it’s not a slap-on-the-wrist like a traffic ticket. NFA tax-payers ought not be subjected to such oppression.”

This I like…

Let’s get an ‘R’ in office and work on it.

On the $200 suppressor stamp, make it a tax collected at time of sale and fire a bunch of the BATF paper monkeys… A win-win…

Oddly, before our Nation was governed by traitors, you could purchase a suppressor through the mail, delivered courtesy of the U.S. Post Office, for about $5, no questions asked and no paperwork required. Sic semper tyrannis!

Yeah, and for another $20 you could have them deliver a machine gun to mount it on.

It is high time SCOTUS did something about this asinine “interstate commerce” b.s. That is the only thing that has given the Feds any authority on gun control. When someone owns a stamped can etc., a move across state lines shouldn’t be considered in “interstate commerce.”

Rant over.

“When someone owns a stamped can etc., a move across state lines shouldn’t be considered in “interstate commerce.”

It isn’t.

I guess you missed this part of the story.

“About three weeks later, I received my letter back along with an Application to Transport Interstate or to Temporarily Export Certain National Firearms Act Firearms (Form 5320.20) along with a form letter explaining to me that I need their permission to move my NFA items (and listing all NFA items except silencers) before I took them in “interstate” commerce.”

I think I will be making that first NFA item jump later this year. Something quiet(er) in .30 caliber…

Got me a trust, but the cans are way out of my range. Maybe 3D printing to the rescue?

I just can’t get over the tax stamp, guess I’m cheap.

Would totally love to see more “NFA for Dummies” type articles! We need to get rid of the smoke and mirrors surrounding it!

I’m still very confused as to how a suppressor can be considered a “firearm” and not simply a “safety device”, after all you only get the 2 ears you were born with. Brains apparently are handed out less reliably.