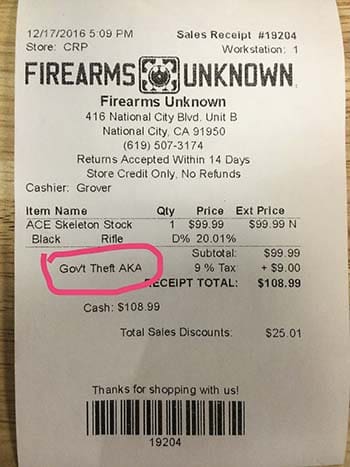

A gun store in National City, California has been the subject of a lot of discussion lately. Several weeks ago, the store gained national attention when a sign twirler hurt anti-gunners’ feelings with a chunk of cardboard shaped like an AR15. Now the store’s sales receipts have drawn attention. Firearms Unknown has chosen to label the line reserved for tax on their receipts as “Gov’t Theft.”

California charges a nine percent tax on gun sales, in addition to a mandatory $25 DROS charge. (DROS stands for Dealer’s Record Of Sale. California forces gun buyers to pay for state registration of their gun.) Although California gun owners are well aware of the fees involved, it’s good to see Firearms Unlimited exercising their First Amendment right of free speech to call the tax on their customers’ Second Amendment rights what it is…theft.

Firearms Unknown’s agitation — and the support the store has received from the gun community — proves that not all California residents are leftists who want to ban guns. As someone who fled the Golden State for the income tax-free Cowboy State (Wyoming), I’m happy to see that those I left behind continue to fight the good fight for firearms freedom. Whether or not they’re a lonely voice in the liberal wilderness, they deserve our support.

Thank you for that. It’s nice to agree with Mrs. Tipton again! I just started the 10 day waiting period a few days ago for a Palmetto AR-15 and AR-10 lower. The taxes and fees ran me about $170. Those were my 8th and 9th gun purchases in 2016. For 2017 I’m looking more at revolvers, bolts, and lever guns.

I’ll give the ATF a week to show up on his doorstep for a thorough audit, complete with a SWAT team, local cops and a news camera team.

To be clearer, it isn’t ‘just California’ nor ‘just guns’. Sales taxes go to the state: 6.25%, and the rest to county and city governments – see http://www.boe.ca.gov/news/sp111500att.htm

My thought. A lot of local taxes there. Up here the tax is “only” 7.5%. But still it adds up quickly, especially when you are buying elsewhere and processing the purchase through a local FFL. The typical transfer fee charged by dealers for an item they did not sell is $75, plus the DROS, plus the sales tax. (Living in a small community, even with four or five LGSs aside from the 2 big box stores, this happens a lot because their stock is limited.) I work with a table top FFL who only charges $25 plus the DROS, but for an A10 lower I bought recently, fees, shipping and taxes totaled $80, almost 50% of the cost of the lower.

“Whether or not they’re a relatively lonely voice in the liberal wilderness, they deserve our support”

My internet “support” and five bucks will get you some coffee at Starbucks.

By the way, you need to proofread.

Publicity, that’s support.

At least 25% of us are 50% sane, for sure.

For those who haven’t been to CA the state isn’t as liberal as it seems.

In what regard? It’s true that large swaths of the state (geographically speaking) are actually pretty red. But that doesn’t matter, because the LA area and the Bay Area are as blue as you can get, and the laws coming out of Sacramento reflect that

In that exact way that you just mentioned.

LA is a bit more multifaceted. Still overwhelmingly ostrich, but not quite the parody of itself that the Bay Area has become.

Interestingly enough, the fact that the people in the Bay Area to such an overwhelming degree actually believe the nonsense they have been indoctrinated to believe, make the police there the friendliest anywhere (assuming you are a proper, non threatening white or asian. Or if not, dress up as one of the above’s gay doll.) While in LA, fear derived from the presence of the occasional nonbeliever, have turned the cops full on paramilitary, lest the majority freaks out that there may be someoene in their zipcode who don’t believe God was a lesbian Aboriginal woman with a learning disbility. And who may therefore threaten their home vaijues.

Florida can be an example for the possibilities in California.. Most of the population centers in Florida trend to the D side of politics but overall this year the State fell to the R side even if just barely.

Yes. It will take a huge amount of work but the rest of the California *can* overcome LA and SF.

“… the rest of the California *can* overcome LA and SF.”

Not when the deep blue Los Angeles and San Francisco areas alone comprise 65% of the state’s population … and ever more illegal immigrants keep pouring in from Mexico.

Note that the ruling class currently in power in California wants illegal immigrants to keep pouring in: it guarantees that they will retain political power forever.

Thats because CA isn’t liberal….it’s leftist.

When you swim in an ocean of leftism long enough you begin to forget that you’re in the ocean.

Not that it makes a difference, but that is the sales tax, which applies to all merchandise sales like the butt stock in the receipt in the article photo, not just guns. It also varies by city (it happens to be 9% in National City). As the author mentions, the DROS fee is the extra slap in the face for gun buyers.

It’s multiple taxation: sales tax plus DROS / BG check / handgun safety certificate / transfer fees, etc. You’d think that the state of CA could do some things for “free” given sales tax that is so high.

They do a lot for “free”. Free healthcare, phones, food stamps, welfare, and on and on for anyone who applies for it. Illegal or not. We pay and pay for this and it keeps the immigrants coming.

I’ve bought a few of my rifles up in Montana just to avoid the taxes. Still can’t buy handguns outside a state of residence though… contrary to the bullshit pushed by the anti’s.

Technically you can, or at least could a few years ago. Still had to be on the white list, had to be shipped to ffl inside ca, still had to dros, etc…

Totally not worth it, and few stores outside of ca bother, except some right inside of Nevada, like the cabelas on I 80.

Ok. It might have been stopped by new legislation.

Negan wants his cut.

Livin’ on easy street.

Bought mine in delaware. 0% sales tax.

If they can levy a $9per item tax on guns, why can’t they have a $9 per copy tax on newspapers? or charge $9 per ballot for voting? or $9 to go to church? or charge the accused $9 per juror to have a jury trial?

Jury deposits vary, but they were higher than that the only time I ever had to consider the idea.

I can only wish deadly cancer on those who hate and fight to destroy the 2nd Amendment.

They are traitorous cowards and nothing more.

School me if you can,

isn’t this whole “sales tax” (in general) thingy double taxation? I mean, income is already taxed right?

sales tax is the tax I hate the least. Here in Texas, we don’t have a state tax. Only sales tax. Which means we aren’t double taxed on a state level. What I like the most is everyone pays. From the slug living on welfare, to the oil tycoon. It’s simple.

I’d like to see all taxes, from sales or income, down to 0. We’re not double taxes, probably more like quadruple-cubed-squared taxed. Every business that makes something is taxed, sometimes double taxed, and that business passes those taxes onto whomever buys their products. Now imagine all the individual products that go into the products that you buy, or the products that go into the processing of the things you buy. If you’ve never read the essay I Pencil by Leonard Reed I highly recommend it, but think about all that stuff is taxed, THEN you’re taxed on it. I wouldn’t doubt that 75% of all money is taxed in some way, shape, or form. I would prefer one income tax that you have to pay in one lump sum, due the day BEFORE election day.

Could be worse. We could have a VAT.

Yes we have VAT. Just like the man said, taxes on every level of making a product. Earnings, sales, business, property and gov’t regulations.

I buy as much as possible via internet to avoid it. I choose sites that do not charge CA tax and get free shipping.

What else do you call the collection of funds through threat of violence? Taxation is theft and Lysander Spooner is my home boy.

NICE! Lysander Spooner shout out!

NO TREASON!!!

“If taxation without consent is not robbery, then any band of robbers have only to declare themselves a government, and all their robberies are legalized.” – Lysander Spooner

Right on man!

Reason 17 of 481 that I left Commifornia. A few parts aren’t liberal, but the vast majority of the residents are.

Between sales taxes, income tax, unemployment taxes, severance taxes and a whole host of others, the place bleeds you dry. I took a $30,000 a year pay cut but now, in my low tax state (Alaska) see my take home is up and my out of pocket taxes are less.

I’m about to exit Louisiana for their ridiculous taxes. New governor Bell Edwards ran on the promise of no new taxes. Within two weeks of entering office he proposed raising taxes. Never trust a Democrat ever! And no I did not vote for him.

Poll taxes. Gotta love them.

I feel your pain. Got sky high taxes in Cook co,IL,$25 handgun tax and boo-lit tax too. Soooo…I try not to buy a damn thing here. I usually make the jump to Indiana and my next handgun is either internet and transferred to a nearby county(who all HATE Cook) or buy at a shop in Will or Grundy county. Sorry your whole crappy state suck…

Geez, TTAG – that’s a very misleading headline, and the receipt shown has ZERO gun-specific fees shown on it. Not even the DROS charge. Just the quickest of searches will tell you that National City charges a 9% SALES tax. Not (as your headline states, and the article supports) a “gun tax.”

As a former California resident, Ms. Tipton (whom I am normally warmer towards that many commenters) is well aware of the state’s love of taxation, so it’s a bit disingenuous to write this entire article about the “gun tax” there, and this store’s brave stand against it.

If one trusts Google, there are only 5 states without a state-level sales tax, so this is hardly a Californian thing.

Still haven’t proofread the article.

Good old Nasty City.

But even more amusing than the anti-tax message is the acronym for the name of the store. Giving the gubmint a big FU.

I am soo wishing for Calexit. I hate that state

All tax is theft. legalized and taken by force.

I think it should also be noted that, per the receipt pictured, the store have the buyer a 20.01% discount, which just so happens to come out to $25.01, which to me seems to basically cover the DROS free in this instance. I’m guessing that’s not coincidental.

You don’t pay taxes, they take them. That’s a “jack” where I come from

Taxation without representation.

California also charges you $25 every 5 years for an idiot gun safety test. All of this is an end-run around the 2nd Amendment and an attempt to deprive rights by undue bureaucratic burden. The second amendment actually indicates the government has NO JURISDICTION whatsoever over any defensive means of the citizens. To alter or abolish an alienated government that becomes adversarial rather than protective of our rights it may be necessary to wield defensive measures against such a mob. So it was never intended that such a gang control our access to or ownership of arms and munitions.