[Republished with permission, by Joshua Prince, Esq.]

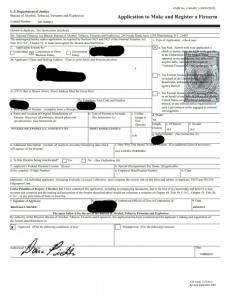

Recently, I have seen a number of people posting approved e-Form applications (Form 1′s), which had me greatly concerned given the translucent nature of the newly utilized electronic stamp. After receiving these approved eForm apps by email, some of the applicants have called the NFA Branch and been told that they will not be receiving a hardcopy and that the electronic copy is their approved tax stamp. But as explained below, there appears to be a…wait for it…loophole in relation to Form 1 Applications. As made explicitly clear by 27 C.F.R. 479.162, ATF’s newly utilized electronic stamps are unlawful and invalid . . .

To start, most gunnies are generally aware that 26 U.S.C. 5811 (dealing with transfers if of National Firearms Act firearms) and 26 U.S.C 5821 (dealing with making National Firearms Act firearms) require the payment for and receipt of a tax stamp for the transfer and making of NFA firearms. Both hold that “The tax imposed by subsection (a) of this section shall be payable by the appropriate stamps prescribed for payment by the Secretary.” Before moving on, just so everyone is clear, the provisions of the NFA discussed below refer to the “Secretary” rather than the “Attorney General”; however, the relevant powers and functions of the Secretary of the Treasury were transferred to the Department of Justice, under the general authority of the Attorney General, pursuant to 28 U.S.C. 599A(c)(1).

Turning back to the issue at hand, what exactly is a “tax stamp?”

Under the Internal Revenue Code, 26 U.S.C. 6801, “[t]he Secretary may establish, and from time to time alter, renew, replace, or change the form, style, character, material, and device of any stamp, mark, or label under any provision of the laws relating to internal revenue.” Section 6804 goes on to declare, “Except as otherwise expressly provided in this title, the stamps referred to in section 6801 shall be attached, protected, removed, canceled, obliterated, and destroyed, in such manner and by such instruments or other means as the Secretary may prescribe by rules or regulations.” Thus, the question becomes, what has the Secretary established, or to whom has he delegated the power to, and what is meant by attached.

As one would expect, Section 6808 then goes on to inform the reader that for special provisions relating to the NFA, to see Chapter 53. So, we need to turn to Chapter 53 to find our answers. In turning to Chapter 53, we are, in part, back to where we started with Sections 5811 and 5821, which mention a tax stamp but do not define it in any meaningful manner. Thus, it is now time to turn to the Code of Federal Regulations.

First, let’s turn to the CFR sections that deal with the tax imposition. 27 CFR 479.61, Tax on Making NFA Firearms, provides

Except as provided in this subpart, there shall be levied, collected, and paid upon the making of a firearm a tax at the rate of $200 for each firearm made. This tax shall be paid by the person making the firearm. Payment of the tax on the making of a firearm shall be represented by a $200 adhesive stamp bearing the words “National Firearms Act.” The stamps are maintained by the Director. (emphasis added)

In turning to the Tax on Transferring, 27 CFR 479.81, we are provided with

Except as otherwise provided in this part, each transfer of a firearm in the United States is subject to a tax to be represented by an adhesive stamp of the proper denomination bearing the words “National Firearms Act” to be affixed to the Form 4 (Firearms), Application for Transfer and Registration of Firearm, as provided in this subpart. (emphasis added)

Hence, under both, there are two requirements. First, it must be an adhesive stamp. Second, it must bear the words “National Firearms Act.” I already see an issue with the above-posted example of a recently approved eForm 1. There is no adhesive stamp. However, if you look very closely, the words National Firearms Act, although blurry, do appear to be part of the electronic stamp.

But our journey isn’t over yet. Let’s turn to the respective sections on Applications. In relation to the Application that must be submitted for the making of an NFA firearm, 27 CFR 479.64 provides

The application to make a firearm, Form 1 (Firearms), must be forwarded directly, in duplicate, by the maker of the firearm to the Director in accordance with the instructions on the form. The Director will consider the application for approval or disapproval. If the application is approved, the Director will return the original thereof to the maker of the firearm and retain the duplicate. Upon receipt of the approved application, the maker is authorized to make the firearm described therein. The maker of the firearm shall not, under any circumstances, make the firearm until the application, satisfactorily executed, has been forwarded to the Director and has been approved and returned by the Director with the National Firearms Act stamp affixed. If the application is disapproved, the original Form 1 (Firearms) and the remittance submitted by the applicant for the purchase of the stamp will be returned to the applicant with the reason for disapproval stated on the form.

And now turnings to the transfer of an NFA firearm, 27 CFR 479.84

Except as otherwise provided in this subpart, no firearm may be transferred in the United States unless an application, Form 4 (Firearms), Application for Transfer and Registration of Firearm, in duplicate, executed under the penalties of perjury to transfer the firearm and register it to the transferee has been filed with and approved by the Director. The application, Form 4 (Firearms), shall be filed by the transferor and shall identify the firearm to be transferred by type; serial number; name and address of the manufacturer and importer, if known; model; caliber, gauge or size; in the case of a short-barreled shotgun or a short-barreled rifle, the length of the barrel; in the case of a weapon made from a rifle or shotgun, the overall length of the weapon and the length of the barrel; and any other identifying marks on the firearm. In the event the firearm does not bear a serial number, the applicant shall obtain a serial number from the Regional director (compliance) and shall stamp (impress) or otherwise conspicuously place such serial number on the firearm in a manner not susceptible of being readily obliterated, altered or removed. The application, Form 4 (Firearms), shall identify the transferor by name and address; shall identify the transferor’s Federal firearms license and special (occupational) Chapter tax stamp, if any; and if the transferor is other than a natural person, shall show the title or status of the person executing the application. The application also shall identify the transferee by name and address, and, if the transferee is a natural person not qualified as a manufacturer, importer or dealer under this part, he shall be further identified in the manner prescribed in §479.85. The application also shall identify the special (occupational) tax stamp and Federal firearms license of the transferee, if any. Any tax payable on the transfer must be represented by an adhesive stamp of proper denomination being affixed to the application, Form 4 (Firearms), properly cancelled.

So, who caught the loophole? It’s in the very last sentence. Come on, I’ve taught you to find these issues by now. Only in relation to a Form 4, do we find the language “must be represented by an adhesive stamp of proper denomination being affixed to the application, Form 4 (Firearms).” If you look above, in relation to Section 479.64, although it mentions affixing the stamp, there is no mention of an adhesive stamp.

In my opinion, this is due to the ATF’s sloppiness in drafting of the regulations. Nevertheless, clearly, I misled you about the the electronic stamps being unlawful and invalid, right? I mean, for fictitious entities, not holding an Federal Firearms License, the only eForms that can be submitted are Form 1 Applications, because all Form 4 eForms are tied to the FFL’s inventory, so ATF is clearly smarter than I and knew this. This is why there aren’t eForm 4 Applications for fictitious entity applications…right?….ooops, Section 479.64 applies to all Form 4 Applications, even those that an FFL submits. So Houston, we have a problem but only in relation to eForm 4 Applications, right? Come on, you know me better than that by now…

But, before I provide the devastating answer that you are waiting for, I need to help you complete the journey that you embarked upon with me for a definition of a “tax stamp.” There actually is a definition that few people are aware of and although not very beneficial, I think it is informative. 27 CFR 479.161, entitled National Firearms Act Stamps, provides

“National Firearms Act” stamps evidencing payment of the transfer tax or tax on the making of a firearm are maintained by the Director. The remittance for purchase of the appropriate tax stamp shall be submitted with the application. Upon approval of the application, the Director will cause the appropriate tax to be paid by affixing the appropriate stamp to the application.

While not overly beneficial, I do find it hard to comprehend how the director maintains, in this context, a tax stamp, which is not tangible (aka an electronic NFA stamp, which could be easily stolen, emailed out, used illegally…but I digress). Again, we see the language “affix” but that by itself, I’m not sure is sufficient.

So, where’s the smoking gun? The one that ATF, who requires all of its FFLs to have strict compliance with the regulations, but fails, itself, to strictly adhere to the regulations? Simple…and it doesn’t even contain complex legal verbiage. 27 CFR 479.162, under the title, Stamps Authorized, provides

Adhesive stamps of the $5 and $200 denomination, bearing the words “National Firearms Act,” have been prepared and only such stamps shall be used for the payment of the transfer tax and for the tax on the making of a firearm. (emphasis added)

Seems pretty clear to me. Only adhesive stamps can be utilized. The translucent electronic stamps are not the adhesive stamps that have been prepared. They aren’t even adhesive!

So what does this mean? It means that ATF has to comply with the law (it wrote by the way) and issue paper copies of ALL approved forms requiring a “tax stamp” with an adhesive NFA stamp.

Some may inquire as to why I am concerned with this and there are several issues. While I believe it may constitute a crime under the Tax Code, as it is NOT a valid stamp that they have been inserting on the forms, my concern stems from the translucent appearance of the approved eForm. What law enforcement officer is going to believe that it is real? I will bet that any LEO, not aware of this issue, and being presented with a printout of an approved ATF eForm will believe it to be a forgery and proceed to arrest the individual for not only possession of an unregistered NFA firearm but also making false statements to law enforcement, forgery, counterfeiting government documents…and the list goes on. This was extremely ill-conceived on ATF’s part and needs to be rectified immediately.

If you have received an approved electronic eForm, I would suggest contacting the NFA Branch. If they refuse to issue you a paper copy, I would suggest contacting your Congressional Leaders, as ATF is violating the law it wrote….

ughhhhhhhhhhhh

just remove the restrictions on SBR/SBS and suppressors already.

I understand that full-auto would be a hell of a political fight, but I can see the former happening at some point.

It always feels strange when talking to my Euro gun lovers, many of whom are REQUIRED to use a suppressor whenever possible.

This. While I want the whole damn NFA thrown out, it would be much easier to unrestrict SBR/SBS and suppressors first. SBR/SBS should definitely not be regulated due to the incredible ease with which one can modify a rifle or shotgun.

Exactly. Especially since the hacksaw in my garage could one day put me in constructive posession. Though I wont hold my breath, its only unlikely and insane until it starts happening.

Can’t remove just one or two items from NFA without the whole thing unraveling….

Um, actually I am pretty sure they can, but whatever.

In Canada, where pistols are “Restricted” and as such must be under lock and key unless actually being shot at a range, a lot of folks use short barrel shotguns as a Non-Restricted alternative, as they are much more lighty regulated, and the storage requirements and penalties are more relaxed.

Of course, the barrel has to be factory short (no hacksaws please) and it has to be pump or lever, not semi-auto.

http://static.globalnews.ca/content/interactives/legacy/grizzly_yes_really.JPG

To say nothing of how incredibly easy it is to convert certain firearms into machine guns? Come on, the entirety of the National Firearms Act is a travesty, it should be removed entirely and without compromise. It’s not going to change much at -all-.

Does this qualify as entrapment?

probably… but once you have 20 million Americans with guns that are all Illegal, that might be hard to correct. Can you say “Term Limits?”….. as in “Your Stamp Just got Cancelled”.

You act as though they made this “mistake” by accident… Seems to me that they can enforce the law that requires the “adhesive” stamp and say that the electronic copies are invalid at any time.

I believe they would have to give me back my $400!

I think Leghorn has a brilliant future ahead of him as a tax attorney, if he so desires. Dear lord, that was some painfully boring regulatory analysis.

My eyes glazed over after about 2 paragraphs… then again NFA rules don’t really affect me, since NFA is pretty much verboten in the People’s Republic of New Jersey.

Not that I disagree with anyone saying the rules should be relaxed/repealed for short barrels and suppressors.

It’s actually an article that I wrote that Nick requested permission to republish, which I granted. So, I am the one who is boring, not Nick 😉

Thank you for the analysis. I actually enjoyed it.

You’d get a kick out of the approve F4 that I just got back, not only is it the whole digital deal, it was one of the very first ones submitted when the e-forms site was completely screwed up. So now I have an approved F4 that has “DRAFT” splashed over it from question 4-8 and the “looks fake” “might not really be legal” e-stamp on it.

BUT it did come back in 3 months so it does have that going for it…

Oh God….I would definitely contact the NFA Branch. I already have a request into Gary Schaible to look into the matter…

I hope my comment didn’t come off as criticizing the author, but rather the mountains of legalese that have to be navigated to not become a felon.

It’s akin to requiring a 500 page book that summarizes New Jersey firearm/weapon laws.

http://www.evannappen.com/gun-law-books.html

No offense taken…I completely agree.

Great article. Question: I just passed the bar and I am interested in firearms related legal work. I would appreciate any advice you might have.

Shoot me an email and we can discuss

I did also use the word “brilliant,” Joshua. 🙂

A ban on SBR’s is stupid anyways. Any criminal or psychopath can simply purchase the parts they need to make a standard rifle into a SBR in a catalogue, or the internet anyways. So really what’s the point???? I really don’t understand how this law is going to prevent anything from happening?????

They should at least do away with this portion of the ban, it really serves no purpose.

But being able to buy SBRs and suppressors through FFLs at your local gun store where they keep records like all “regular guns” is dangerous!!! /s

It’s about the tax money, it has nothing to do with safety or crime prevention.

I’d say de facto ban before tax revenue. Its always been a 200 dollar stamp, even back in 1934. That plus the incredible wait times people are going through. I want a supressor someday, but I’m unwilling to wait the 12 plus months for it to be processed.

I’m unwilling to purchase something and then wait 12 month for permission to actually get it.

And then be on super list where you sign away your rights.

The Gun Ban types use the NFA act to restrict those weapons though. That is why the tax was originally set so high and why the bureau takes as long as they can to issue them.

Someone should determine the legal definition of adhesive before taking this for gospel. There may be case law or a subsequent law that defines electronically attached as being adhesive.

I think the point being made in the article was that due to the questionable legality and validity of the electronic stamps, you should use the paper forms instead of the eforms and if you already got an eform approved, demand a hardcopy from the ATF immediately.

Knock, knock. “I unnerstand yew are demandin’ sumthin from my boys. This here is an SBR, select fire, and a suppressor. If I have to come back, I’ll show you how it works!”

“Demand” from ATF? Have you been sleeping? They kill law abiding citizens without provocation. Review Waco and Ruby Ridge before demanding doodley.

Anybody else here feel this is a way to not only get around the huge backlog of work they have but provide a way to void out Forms?

Nothing like Due Process…………

Call up a federal prosecutor and tell them the NFA branch is violating the law… LOL

A mix up and huge oversight or assault on gun owners in disguise? I’m sure the ATF would love to halt all their pending applications and scare people away from submitting more by threat of arrest while they “investigate” this matter and engineer a solution full of even more such oversights.

And because the process is so complicated, the internal review will take 8-10 months.

Thankyou for your patience and excuse our dust while applications are put on hold.

What an electronic mess! It takes years to officially rewrite/update written laws at the federal level, especially with all the cross-referencing and forgotten subsections.

As it stands now, the terms “affixed” and “adhesive” obviously refer to something tangible.

The xerox or laser printing process actually does affix.

The toner dust is placed on the paper and then melted (affixed) so it is more like the old “kings” ring seal on an official document.

But it becomes part of the document istead of two entities of the paper AND the stamp.

So, does it qualify??

If you have ever pulled a jammed sheet of paper out of the laser printer before it went completely through, the toner dust just smears, then you know what I mean..

Toner particles mixed in with balls of plastic 3-5 microns big that the fuser/fixing assy melts the mixture onto the papers porous surface. Do this on resin coated or glossy material and see what I mean. One could argue that a laser printer/ copier is in fact adhering the “stamp” to the document.

Ah, come on. Print the damn thing and “affix” it with Elmer’s.

This is a non issue. I don’t know why this article was published.

This reminds me of the big SKS roundup in California, where the courts ruled that the AG’s office had no authority to permit their possession, after people had already registered what they were led to believe we’re legal firearms. Confiscation ensued.

Last time I checked the ATF does not write laws. Thankfully SCOTUS is now recognizing this.

Let’s just eliminate the ATF – oops – I forgot who the president and AG are.

More lies from MDA head Mythomaniac!

Shannon I never met a gun control lie I didnt love Watts!

http://www.rawstory.com/rs/2013/11/11/texas-mom-tells-ed-schultz-my-daughters-and-i-get-threats-of-sexual-violence-daily-over-support-for-gun-safety-laws/

Maybe I can pay with a transparent image of 2 Benjamin’s. That seems just as valid.