Guns serve as many things for many people. Many Americans own guns for self-defense. Others own them for hunting, for competition or simply to collect. Similarly, others look at guns, at least to some extent, as a store of wealth or a long-term investment of sorts. But really, are guns a good investment?

Consumer demand for guns has remained strong for generations. Occasionally, demand surges from strong to insane levels after political hacks and opportunists call for more gun control or outright bans. Meanwhile, even during economic downturns such as Obama’s eight years, demand for guns remains a bright spot.

However, just because a steady demand exists doesn’t automatically make guns a good investment strategy. For the most part, when considering financial opportunities, one can do much better than guns. However, if you consider other benefits of gun ownership, the answer becomes less clear cut.

Reasons not to look towards guns for solely investment purposes

Sooner or later, every gun owner tries to sell one or more guns. Like baseball cards, the value of any gun depends on what someone will pay for it. As long as someone will pay a fair price, great. Too often though, people sell guns when they need the money in a hurry. Generally speaking, that makes for a buyer’s market.

You know how that goes. You’ve got a loaded Springfield M1A (above) in good condition in the box listed at $1200. I have some $100 bills. Then the conversation goes something like this: “You might find someone to give you $1200 for that gun someday, but I’ll give you $600 for it right now.”

At the same time, if you “cash out” of your investment by selling it to a gun store, understand they have to turn a profit on your “investment.” For instance, they might only offer $600 on your loaded Springfield M1A in the hopes of turning it around for $1200 next week. Not only that, but if they pay you over $600, you might wind up with an IRS 1099 at the end of the year. Then you’ll have to count it as income and pay taxes on it as well, adding to your loss.

Similarly, trying to sell a gun at a gun show is a great way to attract countless low-ball offers.

On the other hand, if you take your gun to a friendly local gun store and put it up on consignment, you may actually bring home 75% or more of the fair market value. And if they can’t meet your reserve price, you can bring it back home.

I have sold guns on consignment before. In fact, my wife’s engagement stone lived a life as an HK-91 until the month after Newtown. Given the insane demand for modern sporting rifles at the time, my now-wife did very well as I recovered nearly half-again more than I had in the rifle and accessories. Even after paying consignment fees. Unfortunately, when spread over about twenty years, that 50% growth doesn’t look so impressive.

Selling a gun directly to another private party stands as about the only way to do well. But finding the right buyer can prove frustrating and sometimes difficult – and expensive. However, online gun auction sites will, for a fee, help you find buyers.

Lastly, if you look to earn regular income buying and selling guns without a license, watch out. A certain alphabet agency of the federal government that enforces regulations on alcohol, tobacco, firearms, explosives and really big fires may want to talk with you.

Aside from the market issues, one must consider legislative changes as well. Depending on where you live, you may face new legislation banning certain types of popular guns. If the new gun law grandfathers your old gun, you may win. If not, you lose.

Guns make sense as a store of wealth

We all know that gun ownership carries with it an intrinsic value all by itself. And while guns may not make the Forbes top ten list of investments, they do tend to retain their value if well maintained.

A friend of mine calls his collection of guns his “other” 401k. Jeff has acquired those guns as an insurance policy in case the world goes sideways. Regardless of your name or address, that Vanguard investment fund report will not protect anyone from a home invader like a gun will.

At the same time, Jeff also looks to his collection for its historical value. He likes to share his own appreciation of history with both his kid and friends. Obviously, he derives value in that as do plenty of other gun owners and collectors.

Jeff looks at guns mostly as a store of wealth. “Finding a gently used revolver or GLOCK at a bargain price beats maybe earning 1% in my savings account,” he once told me. He has his mutual funds for his investments.

I concur with his take on guns. While I’ve lost my fair share of firearms to tragic boating accidents over the years, I still have a few left. Unlike a car, boat or plane’s value, my guns’ value remain pretty close to steady year over year. Unlike real estate, I don’t have to pay property taxes on it. And unlike the stock market under Obama, I don’t worry about downturns and share prices.

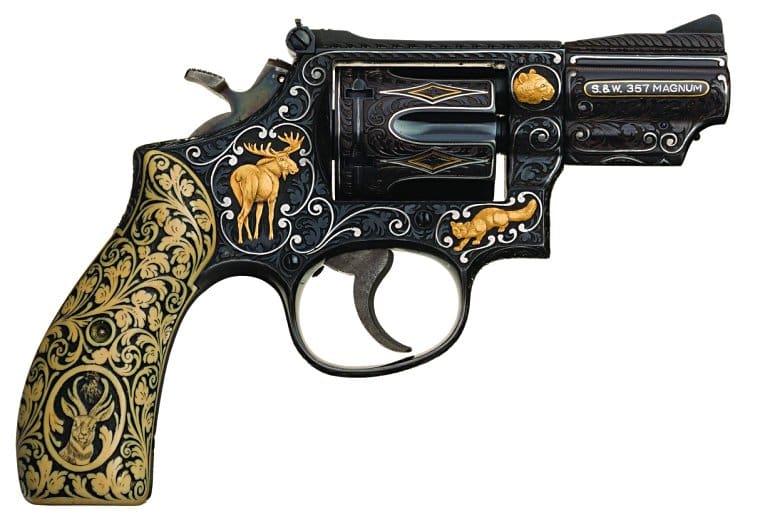

Anyone looking to acquire guns as a pure investment might find the rare specimen in high demand. For instance, Elvis Presley’s Smith & Wesson Model 19-2 pictured at the top sold for $195,500. However, most of us will never find a needle like that in a haystack. Finding a good mutual fund, with or without the help of a financial advisor, proves a lot easier and will probably deliver a better return on investment. Especially for one’s IRA.

Instead, people like us, now and then, find a popular firearm in a mainstream caliber at a bargain price. Something like this will seldom serve as a poor place to park a few hundred bucks. As an illustration, Americans love America’s favorite rifle, the AR-15. Unlike a bar of silver or a gold coin, that AR just might save your life. Or a family member’s. Ditto for a GLOCK.

For those who think they can successfully invest in guns, have at it. But keep in mind that the quickest way to make $100,000 investing in guns is to start with $200,000.

Further reading

Some guns store value better than others. Here’s a list of some of the most collectible guns.

If you are storing significant value in your gun collection, here’s some straightforward advice about insuring your firearms.

No.

Liquidation at or below purchase price is not an investment.

But one thing guns have taught us is that investments are not all monetary.

Guns are, however, a great way to lose money if that’s all they are used for.

I do have a sick fascination watching the same Armslist firearms ads appear week after week after week with the price slowly dropping and the ad text more desperate. Most of the ones I track are tricked out AR platform rifles and enhanced Glocks. You know the owner dumped a pile of dough into the build wanting to be the coolest kid at the range, but the first scratch or the next generation makes the current gun just a bad taste in the financial mouth.

And then there are those people who bought high under mass-shooting panic and now have a never-recoverable amount of money wrapped up in a run of the mill AR. Who cares what you paid for it! Maybe I’ll give you half your asking price. Nah, make that a third. Take it or leave it.

I figured you’d take it. (but if you were smart, you’d learn your lesson and just shoot the heck out of it and get on with your life)

Wonder how many of those panic buyers compounded the mistake by using plastic?

I know a gun counter worker in a local semi-boxbox store. When was the last serious panic? 4 years ago?

He said people were all but running in to grab whatever AR pattern rifles were there. Some people were buying multiple units. The VERY LAST UNIT they had was higher-end Grendel. Panic buyer didn’t care what is was, I want it.

More than 90% of the units sold were on plastic.

Less than 3 month later, there were firesales at a couple gun shows to pay off their bills. Armslist and related sites were awash with local people looking to dump their “inventory.”

I think ahead. I reason ahead. I don’t panic. I have some collectables, but nothing being used for a future college fund.

‘Tis sad to watch that.

The last AR to walk out of my LGS during the hype was some $4500 carbon fiber AR15 monstrosity. I was there watching the buyer explain to his hesitant wife just why this was an essential purchase.

That same rifle can be today had for a little over $2k now, and even then it’s a tough sell.

There is a reverse that is also true now. I know gun shops with basements full of ARs stacked like cordwood. They keep their inventory secret, but those that can ride out this financial doldrum will be ready when there’s another rampant fear of restriction.

Same with .22 ammo

Same with 30 round magazines

Same with bump stocks

Same with pistol braces

Same with green-tip 5.56

Same with Tanerite

Same with Glock 33 round mags

…..

Buying guns when the getting is good and the price is low, sure. You can flip stuff for a tidy profit when the panics come. You need to have disposable income to do that though.

I do think new/unused guns, name brand ones, to be an alright place to park money. Guns don’t devalue much when used and well cared for, they pretty much don’t devalue at all if they are kept new in box. They also have utility value and are manufactured product, they will never be worthless.

I say the truth is somewhere between it all. Diversity of assets, some good guns, metals, fruit trees, other commodities, and ultimately, toilet paper. Toilet paper… will always be a commodity.

My biggest rifle purchase is only valued about $800 less than what I paid for. (50 Caliber rifle) Bought it when Obama was in power and the rifle was relatively new, now we are under Trump, several years later. Money was fast and loose then and I was still enlisted so I had plenty of disposable income. It was ordered from a LGS out of state that had it in stock and I don’t have any grips over the full retail price going to support LGS.

“they pretty much don’t devalue at all if they are kept new in box”

Unless one lives in the occupied territory of California, that brand new Gen 3 Glock 17 is long in the tooth. Same for the Ruger Mark II. Even the venerable six shooter in .357 Magnum doesn’t look like a bargain compared to the new seven and eight shooters.

It doesn’t matter what you invest in, you will probably never get your money out of it. Not even gold, diamonds or silver are investments you can trust to improve your position because prices fluctuate. The same is also true for classic cars, antiques, etc.

I invested in a classic car. Not because I expected to sell it at some humongous profit but because it was the first car I bought when I returned from Vietnam. So far, I have about $60k invested. starting with a body that cost $9k. I bought it to drive and enjoy.

I’ve invested in other things, like guns with engraving and gold inlay because they stood for some part of my life. Expensive watches because they were part of my life; like working with the Space Shuttle program I bought the same watch the astronauts were equipped with, and another because it was an anniversary gift from an ex.

I never expect to get my money back, though, if I do, that’s all the better. Of course, I don’t plan to get rid of anything either.

My outlook is to buy what I can afford for the simple pleasure of enjoying my purchase. Beyond that, it’s a crap shoot. I do tend to buy those things I can use. For example, I have no problem driving my classic, wearing an expensive watch, or shooting a finely decked out firearm. I’m the opposite of many collectors in this way. They wouldn’t add an extra mile on a car, risk their watch being scratched, or mar the finish on a handsome engraved revolver.

Just my take on the subject.

Yes.

Next question.

(Sigh…) okay. Fine. They’re an infinite money sink and I’ll never find that one gun that completes my collection. Moreover, since I hate parting with any of them, I can hardly be said to be turning a profit… the safe just keeps getting fuller…

🤠

When the sides bulge out the safe ain’t really fuller. It’s broke. Which is something to be proud of.

I like guns. I use them for recreation, hunting and self defense. Making a profit doesn’t enter into it. I’ve given more guns away than I’ve sold. I like to think I’ve done my bit to convert people to potg. One gun at a time.

Guns brings me peace of mind. They don’t have to be profitable in addition.

Surplus. Thats where the actual increasing value is. My K31’s are worth astronomically more than the 120 bucks i paid for each of them 11 years ago, and steadily increasing.

My remaining Mosins too, i regret ditching the ones i did a while back when i “only” got a %300 ROI after 3 5 years ;).

With i would’ve held onto my SKS’s as well :/

Russian and Chinese guns seem to be ever-increasing in value in general, for as long as that ridiculous “Sporting Use” ban remains in effect.

But i can’t see my Surplus collection going anywhere but up in value. Same goes for popular, old guns in good condition, that are no longer in production.

Interesting read….I concur with most everything stated in the article. However, trying to buy modern, current production, guns with the hopes of them appreciating in value is just not going to happen. When buying guns for investment/resale I first ask is it still being made? If the answer is yes then I will pay someone 50% of current retail. If it is not being made currently then I look to Gun Broker under compleated auctions to guage the market then offer about 50% – 70% of market. I do have an FFL and have done this hundred’s of times and made a nice profit. If I’m buying a military/collectable gun and the condition is excellent to mint then keep in mind “you can never pay too much you can only buy to early”. Either way the fun I have and the people I meet beats earning 1% per year in savings!

That’s why you don’t sell to dealers “ever” and don’t sell in a hurry on a whim.

Otherwise yes, you will turn a profit. Just a couple years ago I bought “wayyyyy too many” Swiss K31s, Swiss 1911s, Swiss Schmidt Rubins 1889, and K11s. I could sell them now for quite a lot more, especially if I took my time to do it, and not sell it at the local tight wads dealership (gun store, pawn shop, etc.). I also bought a ton of Spanish 1916 308s and although nobody liked them when they were plentiful, you can’t find them now.

Typically you aren’t going to make much with yesterday’s plastic fantastic. Maybe in another 10 or 20 years from now.

Never be in a position where you are under financial pressure to sell. Guns aren’t your savings account, or emergency fund. That is what money is for. Six months of living expenses available in an emergency fund pretty much guarantees that you won’t Have to sell your guns. If you decide to sell them, you can take you time and sell them for what they are worth.

I’d laugh at a fool offering me $600 for an M1A (which I sadly don’t own anyway). I would sell him my Norinko SKS for $600.

On the other hand, I think being ready to snap up good deals and you see them is great. I guess my point is that “cash is king”, and it is good to have some.

I don’t “invest” in guns. Collecting and shooting them is a hobby. That cost of that hobby is just a little easier to swallow with the knowledge that they will hold their value or possibly increase in value. The loss comes when I feed them…

Perversely, the best investments in firearms are those models which fail in the marketplace. Especially failures with novel features unappreciated during their production period.

The not so secret is to buy the right firearms. The common stuff is hard to make money on. I once paid $2000 for a Browning Superposed pigeon grade in 20 gauge strictly to flip for profit. Blue booked for $4200. Sold it to a local high end gun store for $3500 a few months later. Just before hunting season opened. Timing is also a factor. More recently I bought a very nice ’03A3 for $800. I was offered $1200 the same day. I turned the offer down, but the potential profit was there. The worst I’ve ever done is break even. In the meantime I had use of the firearm. So maybe that was my profit.

Firearms are useless without ammunition. Investing in “brass, copper, and lead” will being back dividends in spades IF the SHTF.

Commercial ammunition will be worth its weight in gold if the UN treaty on small arms is imposed on us.

California has already instituted “background checks” and other limits on ammunition sales. Look for other liberal states to follow suit.

It is “better to have it and not need it than to need it and not have it:”.

I think we are about at the lowest prices on ammunition we are going to see even adjusted for future inflation.

How sure are we:

1.)That 2a supporting politicians will win and continue to win at state and federal levels?

2.) Metal prices of brass, lead, copper etc won’t substantially increase?

3.) that there will be no civil war, rioting, or other period of civil unrest?

4.) Other unforeseen availability issues (for example, a solar flare EMP that knocks out all our electrical infrastructure.)

Buy ammo cheap, stack it deep. Add extra load bearing posts or sister brace the floor as needed.

I usually don’t buy guns thinking of profit. I am a collector. I buy them because I like them. Haven’t sold a gun in decades, even then, I mostly traded them. Some of the guns I have I haven’t even fired them in years, but I have ammo for all of them and reload for all calibers I own.

Plenty to criticise Obama about but “And unlike the stock market under Obama, I don’t worry about downturns and share prices.” doesn’t make a lot of sense given that (based on the S&P500) the stock market was up ~220% while he was in office (with all indices setting records). Both the market & economy were in a free-fall when he entered the office. And given the great recession started when Bush was President the comment “Meanwhile, even during economic downturns such as Obama’s eight years, demand for guns remains a bright spot.” makes even less sense. During his 8 years in office the economy gained a net 11.6 million jobs with the unemployment rate dropping below the historical norms. After-tax corporate profits also set records and with the exception of his first year related to what he inherited from Bush, he had positive real GDP growth every year. As an economist & investment advisor, I think it would be a mistake to think of modern mass-produced guns as an investment. There are certainly rare & collectible guns that do meet the criteria, but as with all collectibles (art, antiques, autos etc) markets can change very quickly and rarely go in just one direction.

I buy guns as an investment, but I wouldn’t drop a dime on that ugly ass Revolver!

A gun may be a good investment, but guns — especially modern Tupperware — are a terrible investment.

Gee I buy and sell for a living(such as it is). I have made a profit selling firearms but only a few times. Oh and 1099’s are for rank amateur’s…

Yea, the tax thing in the article was certainly something to disagree with. If the purchase was made at 1200 and the gun was sold at 600, there certainly was no profit to deal with. Even if the 1099 was issued, the 600 dollar loss more than makes up for the sale. That was a pretty dumb statement.

I can here to also comment on the 1099 issue. If you get a $600 1099 and pick up $600 of income on your tax return you are seriously doing things wrong and need a new CPA.

I don’t buy guns to make money from them. I’m sure there are very skilled and knowledgeable collectors of the very finest and most rare weapons that can and do make money from them.

I think of it like this: when everything – literally EVERYTHING – except food and water is absolutely valueless, firearms with ammunition are pretty much priceless.

So not literally everything. . .

Shelter, transportation, survival gear, medicine, sex, drugs, alcohol, and many other things will still have value even in a complete societal meltdown.

Echoing some sentiments that have been expressed here:

If you’re talking about Glocks, Colt 6920s, or a Ruger Mini-14 then you’ve invested poorly.

If you’re talking about Winchester 94s, M1 Garands, German Mausers, or virtually any US infantry rifle pre-60s, you’ve invested wisely. What has held me back from selling anything C&R is that the prices just keep going up, and what might fetch me $900 today, will probably fetch $1500 in just a few years. In CA gun laws have indeed caused artificial inflation of prices for more modern, more common guns, but that is really an anomaly over all.

I agree with you but they can’t go up forever. Under current individual income and debt levels, at some point the “common collector” will not be able to afford a $6,000 1911A1 made in 1943; unless overall wages and standards of living go up proportionally and then did the value of your firearm actually go up or did it just keep pace with inflation? And if the common collector can no longer afford those types of firearms then will lack of demand drive down the values? No matter the answers I will still keeping buying C&R stuff cause that is where the money is.

When the cheap AK parts kits started entering the country @$79 each, including the barrel, I bought a few, but wished I had had the cash to buy a few dozen of them. I built a few for myself and sold a few of the kits later, but it would be great to have a crate full of them in the garage now!

Similar price increases with other kits – like FN-FAL and HK91. Unless the laws change dramatically to disallow or make much more difficult the building of your own firearms, kits will almost always be a good investment, with fairly short term return.

Honestly, my ammo investment has turned out well. I still have battle packs of 5.56 Nato that I bought for $30 each that are worth $100 plus. More when ammo got scarce.

The one way I found, or at least believe, that you can really ‘make’ money on firearms is to go through the process of getting your FFL.

There are several states, about 12 last time I checked, that police cannot destroy confiscated firearms and must sell them. However, most of them use propertyroom.com or budsguns or some other site to sell them; basically Ebay with a background check. A handful, however, only sell to FFL holders. Since they are selling to FFL holders it cuts down the people bidding and keeps the prices lower. One state the highway patrol runs the auction and charges sales tax; the other uses an auction house that tacks on a flat fee, a sales tax, and an auction fee. You can still buy a highpoint for 20 bucks and after charges end up paying only 50.

I use the 50% rule: if I can’t get it for 50% of what I’m selling it for, I won’t make any money.

Since it was brought up, I’ve never understood the whole hoarding gold thing. People who do it always claim for some future economic collapse, which is likely at some point. However, I don’t get why you’d hoard a precious metal you can’t do anything with. If the economy crashes to the point where society essentially crumbles, I know for damn sure I’m not accepting gold as a payment for anything. What’s its value? Because it was in the olden days? In that scenario it’s as worthless as paper money. Might as well hoard bottle caps. If you can’t eat it, drink it, shoot it, smoke it, or F it, no ones going to want it.

The idea is that there is going to be a crash or hyper inflation followed by a reconsolidation of order. Imagine a Venezuela scenario: the 100 dollars you have today is worth 10 dollars by the end of the week and 1 dollar next week. Gold, however, can be traded at its value regardless. You are correct that in a true end of the world scenario it would take a while for it to recover its value.

It was also sold as more of an investment for people at or nearing retirement as a safe store of money; they didn’t even buy physical gold but more like gold stock. A good retirement plan has you taking risks when you are younger then moving into bonds as you age; the return is less but it is safe. Gold was that safe bet.

What if your local currency tanks, but the world doesn’t fall apart? For example, someone in Venezuela converted Bolivars to gold some time ago. The gold retained it’s value, while the Bolivar didn’t. Gold will do you a lot more good when you get to Columbia. Gold is universally valued, and is highly portable.

I wouldn’t put much money into gold, but a little bit seems reasonable.

For me gold/silver are very necessary. If the monetary system takes a dive, I have an agreement with both the farmers I buy my grass and alfalfa hay from. They will accept either gold/silver for their hay. Also, in my state the gold/silver standard has been passed so it is legal tender. I don’t exactly know how it works as I’ve never tried. I’m pretty sure other states have also passed a gold standard law. And remember, gold/silver has never been worth nothing unlike fiat currencies.

it is worth remember that in Medieval Europe at one point every single coin that was transacted had to be measured, weighed, and tested. Due to debasement of currency you had people shaving, sweating, and melting coins to change their purity. Shaving the sides of one coin doesn’t get you much; shaving a thousand makes more.

Gold and silver are only good if you know what gold and silver are. I could hand you a 1 oz bar of gold claiming it is 24k; how do you know it is 24k? Maybe I mixed in some lead, maybe it even has a lead core. Do you have a scale handy to weigh it and check the prices?

How much hay is worth 1 oz of pure gold? How do you know if they are demanding too much or too little? If, say, the US dollar tanks are you going to index your gold vs the Euro? The Peso? The Yen?

There is a ‘gold line’ in the early history of the world. From about India to the West, gold was both a coin and a value. East of India, fiat money was used. China used bronze coins for centuries. The only reason they demanded silver, and not gold, from the European traders is because at that time European goods were trash and silver was the only thing they wanted.

Counterfeiting has always been a problem including paper money. For the purchase of hay, I will use 1/10 oz American Eagles and junk silver (pre 64 90 % silver coins). They are highly recognized by almost all. The value of each to be determined by the market.

There was a time when all US coinage was required by law to be of either gold or silver.

They are if you have a collection of machine guns and control the largest (alleged) gun rights organization and work your ass of to keep the Hughes amendment in power. So basically only if you’re Wayne LaPierre, Chris Cox and Marrion Hammer.

You’ve stepped into the twilight zone.

yeah,..the prices i’m being offered for some of my class III items are just crazy…I recently sold a sten gun…that was originally worth about $250…for three grand…and was told I probably could have gotten more for it…gettin’ too old to play rambo so i’m probably going to let some go….

When I was moonlighting at Interarmco in the late 1950s, a casually DEWATed Sten gun retailed at $14.95. Thompson 1928A1s and StG44’s were $79.95. I guess timing is everything.

Eh.

As far as tangible investments that can used in everyday life…

They’re cheaper than Swiss watches for an equivalent storage space, and for the same net value require much less storage than classic cars.

Which is one reason Mrs. C doesn’t mind my amateur gunsmithing and collecting hobby.

Many firearms in very good (or better) condition are a solid investment. While they will never increase in value like a carefully chosen stock portfolio, they will increase noticeably. And given their significant utilitarian value to boot, how can you go wrong?

Here are a few examples:

1) Roughly 20 years ago surplus Mosin-Nagant rifles were available for $50 each, now they cost upwards of $250.

2) Roughly 12 years ago surplus AK-47 rifles were available for $200 each, now they cost upwards of $400

3) A Winchester model 94 lever-action rifle in excellent condition that someone purchased in 1970 for $150 will now sell for over $600.

And how about this: I purchased a brand new stainless steel Ruger GP100 .357 Magnum revolver 7 years ago for $530. I have the original box and it looks and functions like brand new. I can sell that on the used market to a private purchaser for $550 or more. And in another 7 years I will probably be able to sell it for $600 or more. While that is not an impressive gain, it sure beats having money in a savings account or having dollars stuffed under your mattress. And I have a useful tool that I can enjoy and possibly save my life in the meantime.

Of course the key to realizing a gain in value on your firearms is buying the right firearms in the first place, selling them to a private buyer, and being willing to wait a few weeks to sell them.

The best gun investment is the gun you need to save your and your family’s lives. Older rare firearms can be great investments, even those without Nazi markings. Of course, if you had 20 or 50 full auto weapons with NFA papers before 1986, you are rich today.

Mass produced firearms using modern machining practices have pretty much assured us in the US with less expensive firearms and I wouldn’t look at these weapons to ever be “rare”, but will have values for what they are.

I can not really think that paying 90% of “street” new value for a used weapon is a good deal. Unless the weapon has some provenance, I would rather spend the additional 10% and have a new firearm. Just add the cost the mandatory state fees(at least here in Ca), and you will see that there is no real advantage to buying used.

In the late 70’s to late 80’s here in aussie you couldn’t give away a quality British double gun. Good ones now are becoming very hard to find.

I started my collection in 1995 when the market was starting to climb and while not having sold any, they have appreciated nicely.

I now focus on the more rare double guns such as Damascus ejector guns and mid-high range sidelocks, some by Provincial makers who knew their trade well, and some by well known makers such as Westley Richards / Charles Boswell / William Cashmore to name three.

I do shoot them in Vintager comps and bird hunts and mainly enjoy them for their lithe lines and attractive furniture.

Will likely never sell as one son loves them as much as I do however their cash values have increased even since the mid 90’s by 20-75%.

All depends on the maker and quality……

Buy quality firearms that are no longer made, and buy the highest quality example of the model in question. This is like buying land: “They’re not making any more of it.” The reason why I buy old SxS American shotguns is that they’re not making any more of them.

The issue with firearms is that they, like real estate and art, have limited liquidity. You have to wait for the correct buyer to come along. Most gun buyers who then sell firearms haven’t the patience to wait for the right buyer to come along.

Guns are extremely durable. Unlike any other consumer good they will always be as useful as the day they were made if you do basic maintenance. A functional vintage 1911, Garand or Mauser K98 will render you just as dead today as they did in 1945. Used guns prices will track closely to 70% of new prices unless they are tricked out monstrosities or rare gems.

A well made gun is worth its weight in gold.

There is only one precious metal, and it comes bored and chambered in your favorite caliber.

Gold takes a lousy edge and makes a crappy shovel, and if SHTF you won’t be able to trade a dump truck full of it for a can of beans or a gallon of gas.

Machine guns are very good investment I’ve been told by many gun experts and gun podcasters. They are especially good investment since most of those same podcasters and gun experts do not support bump stocks. Bump stocks would eventually Force the value of real machine guns down. Because the general public would have access to cheap Rapid Fire guns.

If you got 600 for your 1200 dollar gun and received a 1099 , you would still have zero taxable gain to report. Don’t let that scare you from selling!